The Mileagewise - Reconstructing Mileage Logs Diaries

Table of ContentsUnknown Facts About Mileagewise - Reconstructing Mileage LogsNot known Details About Mileagewise - Reconstructing Mileage Logs 6 Easy Facts About Mileagewise - Reconstructing Mileage Logs ExplainedThe 25-Second Trick For Mileagewise - Reconstructing Mileage Logs6 Easy Facts About Mileagewise - Reconstructing Mileage Logs ExplainedMileagewise - Reconstructing Mileage Logs Fundamentals ExplainedUnknown Facts About Mileagewise - Reconstructing Mileage Logs

Timeero's Shortest Range attribute recommends the fastest driving course to your workers' location. This function boosts productivity and adds to set you back savings, making it a crucial possession for organizations with a mobile labor force. Timeero's Suggested Route function further improves responsibility and performance. Workers can contrast the recommended course with the actual route taken.Such an approach to reporting and conformity simplifies the frequently complex task of taking care of mileage expenses. There are numerous advantages associated with making use of Timeero to maintain track of gas mileage.

Mileagewise - Reconstructing Mileage Logs Things To Know Before You Buy

These extra verification actions will keep the Internal revenue service from having a reason to object your mileage records. With exact mileage monitoring innovation, your employees do not have to make rough gas mileage estimates or also fret regarding mileage expense tracking.

If a staff member drove 20,000 miles and 10,000 miles are business-related, you can write off 50% of all automobile costs (mile tracker app). You will require to proceed tracking mileage for job even if you're using the real cost approach. Maintaining gas mileage records is the only method to separate business and personal miles and provide the proof to the IRS

The majority of gas mileage trackers allow you log your trips manually while computing the distance and compensation amounts for you. Many also included real-time journey tracking - you require to begin the application at the start of your journey and stop it when you reach your final location. These apps log your begin and end addresses, and time stamps, in addition to the overall distance and reimbursement quantity.

Unknown Facts About Mileagewise - Reconstructing Mileage Logs

Among the questions that The IRS states that vehicle costs can be considered as an "average and necessary" expense in the training course of working. This consists of expenses such as fuel, maintenance, insurance, and the automobile's devaluation. Nonetheless, for these expenses to be thought about insurance deductible, the vehicle ought to be made use of for company functions.

4 Simple Techniques For Mileagewise - Reconstructing Mileage Logs

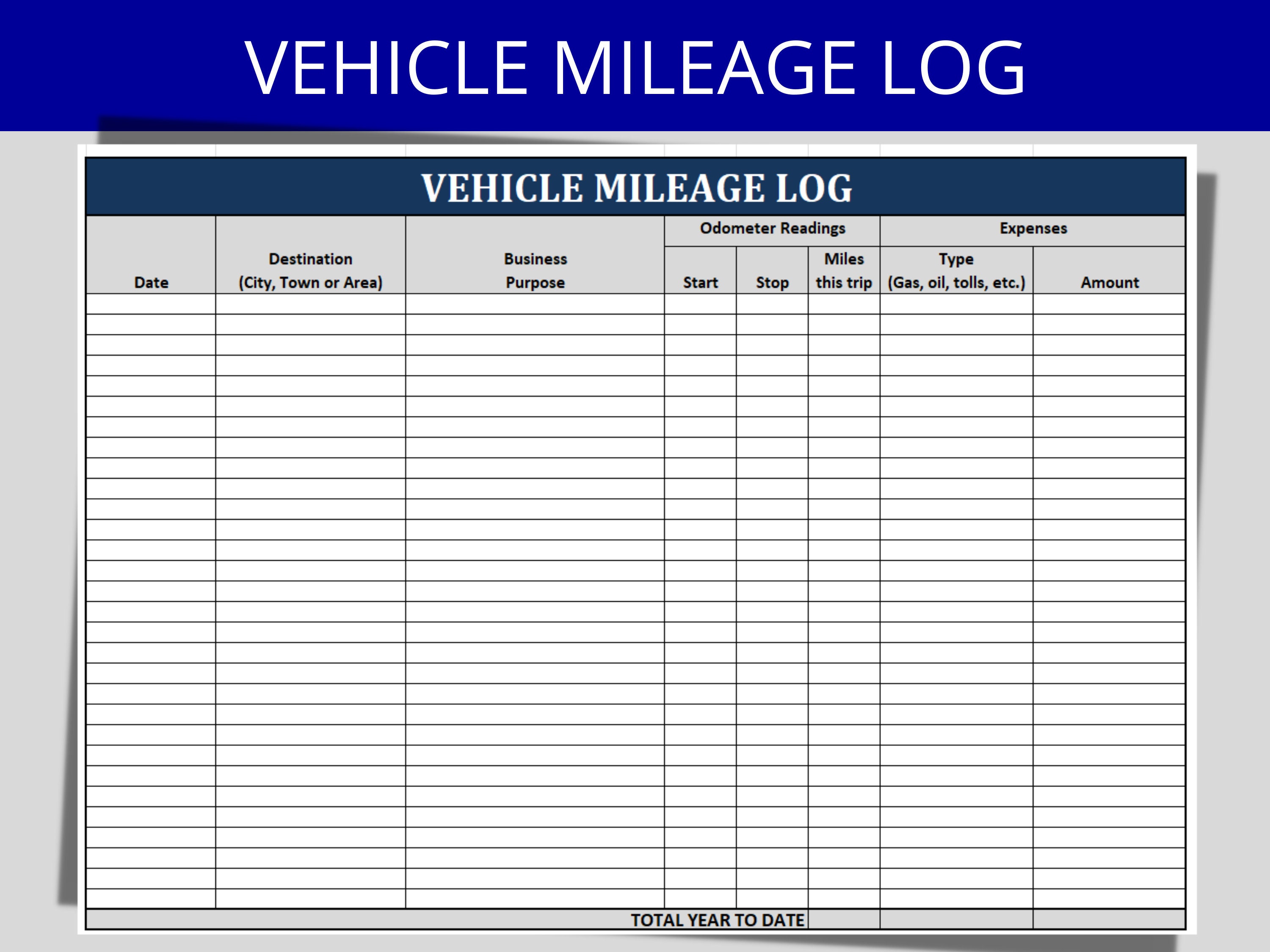

Beginning by recording your vehicle's odometer reading on January first and afterwards once again at the end of the year. In in between, faithfully track all your service trips taking down the beginning and ending readings. For every trip, document the place and company purpose. This can be streamlined by keeping a driving visit your car.

This consists of the total service mileage and total mileage buildup for the year (service + personal), journey's try this web-site day, destination, and purpose. It's necessary to tape-record tasks immediately and maintain a coexisting driving log describing date, miles driven, and business function. Below's how you can enhance record-keeping for audit purposes: Begin with guaranteeing a meticulous mileage log for all business-related travel.

Mileagewise - Reconstructing Mileage Logs - Questions

The real expenses technique is a different to the basic mileage rate technique. Instead of computing your reduction based on a predetermined price per mile, the real costs technique allows you to subtract the real expenses associated with using your vehicle for company functions - best mileage tracker app. These expenses include gas, maintenance, repair work, insurance coverage, devaluation, and other relevant costs

Those with considerable vehicle-related expenses or special problems may benefit from the real costs technique. Eventually, your chosen technique needs to line up with your details financial goals and tax obligation circumstance.

The Definitive Guide for Mileagewise - Reconstructing Mileage Logs

(https://hub.docker.com/u/mi1eagewise)Whenever you utilize your vehicle for company trips, videotape the miles traveled. At the end of the year, once again take down the odometer analysis. Determine your complete service miles by utilizing your start and end odometer analyses, and your recorded organization miles. Precisely tracking your specific mileage for company trips help in validating your tax reduction, specifically if you choose the Standard Gas mileage method.

Monitoring your gas mileage by hand can need persistance, however keep in mind, it can save you money on your taxes. Adhere to these steps: List the day of each drive. Tape the total mileage driven. Consider noting your odometer readings before and after each trip. Jot down the beginning and finishing factors for your trip.

Fascination About Mileagewise - Reconstructing Mileage Logs

In the 1980s, the airline market ended up being the very first business users of general practitioner. By the 2000s, the delivery sector had taken on GPS to track bundles. And currently virtually every person makes use of general practitioners to navigate. That indicates almost everybody can be tracked as they go regarding their organization. And there's the rub.